Shopping for Minnesota homeowners insurance can feel overwhelming. With so many companies and coverage options, the process might seem complicated at first. Fortunately, there are simple ways to compare quotes and find the right policy for your home.

Understand What Influences Minnesota Insurance Costs

Several factors affect the price of homeowners insurance in Minnesota. One major factor is the location of your home. Homes in areas prone to storms or flooding may have higher premiums. The age and condition of your house also play a big role. Older homes or those needing repairs can cost more to insure due to a higher risk of claims.

Insurance providers also consider your personal claims history. If you have filed several claims in the past, you might see higher quotes. The coverage limits and deductibles you choose impact your costs as well. Higher deductibles mean lower premiums, but more out-of-pocket expenses if you file a claim.

Lastly, your credit score is used by many insurers in Minnesota to help set your rate. A good credit score can help you secure a lower premium. Understanding these factors helps you make sense of the quotes you receive and identify ways to save money on your policy.

Gather Essential Information Before Comparing Quotes

Before you start comparing Minnesota homeowners insurance quotes, gather some key details. Start with your home’s address and basic information such as the year it was built and the square footage. You will also need to know about special features like a finished basement or a detached garage.

Have details on your home’s construction materials ready. Insurers often ask about the type of roof, siding, and foundation. If you have made updates such as a new roof or electrical system, note those too. These upgrades can sometimes lower your premium.

You must also provide information about your personal property and the amount of coverage you want. Think about the value of your belongings and any high-value items such as jewelry or electronics. Being prepared with this information speeds up the quoting process and ensures you receive accurate quotes.

Use Online Tools to Compare Homeowners Insurance

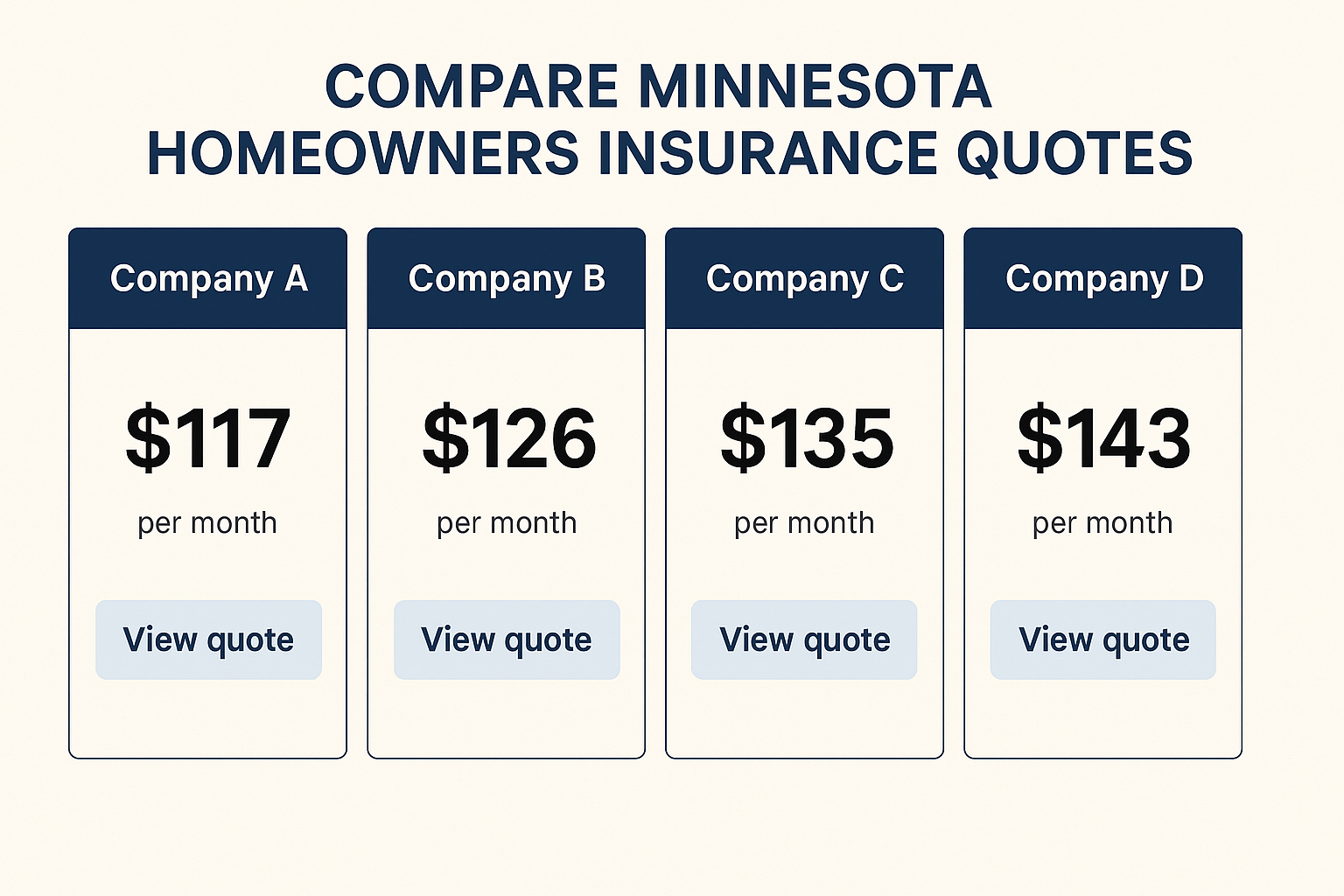

Online tools make it easy to compare Minnesota homeowners insurance quotes. Many insurance companies have quick quote forms on their websites. These forms guide you through a series of questions about your home and coverage needs. Once you complete the form, you receive a quote in minutes.

You can also use insurance comparison websites. These sites let you enter your information once and receive quotes from several insurers. This method saves time and gives you a broad view of what different companies offer. Be sure to use reputable sites to protect your personal information.

Remember to check if the quotes include all fees and standard coverage. Some tools may only show basic policies, so look closely at the details. Comparing online lets you review options at your own pace and helps you spot the best value.

Review Coverage Options and Choose the Best Policy

Once you have your Minnesota homeowners insurance quotes, take time to review each one closely. Look beyond the price to see what is covered under the policy. Check for coverage limits, deductibles, and any exclusions that could affect you if you need to file a claim.

Pay attention to optional coverages such as flood or sewer backup protection. Minnesota weather can be unpredictable, so these add-ons may be important for your peace of mind. Consider your personal needs and risks when deciding which options to include.

Finally, choose the policy that offers the best combination of price and coverage. Reach out to the insurance provider if you have questions or need clarification. Picking the right policy means you can protect your home and belongings with confidence.

Conclusion

Comparing Minnesota homeowners insurance quotes does not have to be a difficult task. By understanding what affects your costs, gathering the right information, and using online tools, you can easily find the best policy for your needs. Take your time, review your options, and secure coverage that will keep your home protected for years to come.